Attention governments: There’s more to giving out grants than handing over the money

Posted on 18 Feb 2026

Around 50 per cent of all funding for charities in Australia comes from government. The nature of…

Posted on 09 Apr 2024

By Greg Thom, journalist, Institute of Community Directors Australia

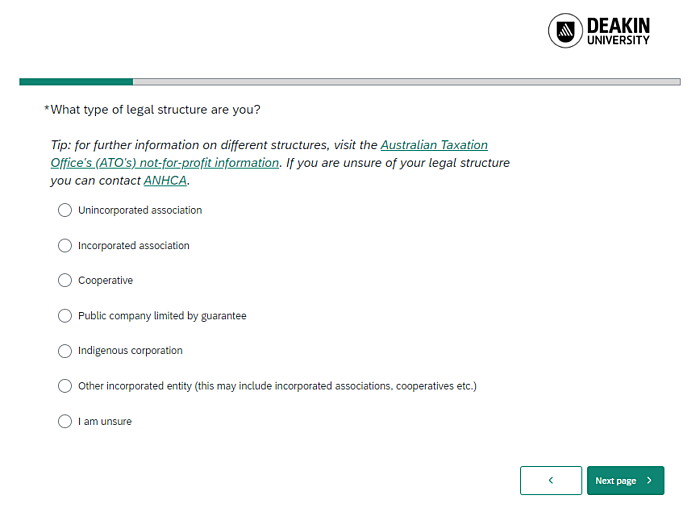

University researchers have developed an online survey tool designed to help not-for-profits navigate a potential tax red-tape tangle.

The Charity and NFP assessment tool could help many under-resourced, volunteer-run organisations avoid losing their tax-exempt status ahead of administrative changes being introduced by the Australian Tax Office.

From July 1, more than 157,000 non-charitable NFPs with an ABN must lodge an annual self-review return or risk losing their income tax exemption.

ATO assistant commissioner Jennifer Moltisanti has described the new reporting requirements as “the most significant change to the sector since the introduction of the Australian Charities and Not-for-profits Commission (ACNC) in 2012.”

However, experts fear many organisations lack the expertise to navigate the required changes and will be unable to meet the ATO deadline.

In recognition of the pressure many NFPs are under to get their fiscal house in order, Deakin University has teamed up with the Australian Neighbourhood Houses and Centres Association (ANHCA) to create what they believe is a simple tool to help.

The diagnostic tool guides users through an initial review of their organisations constitution and provide direction on next steps that are required to get match fit for the tax office.

Deakin University's executive dean for the faculty of business and law, Professor Jenni Lightowlers, said thousands of community groups will be grappling with the ATO's regulatory changes.

“Their tax-exempt status, and ultimately their future, is under threat if they don’t get this right,” she said.

“We want to empower them to develop a strong and sustainable path forward in a way that feels manageable.”

The diagnostic tool was developed after Deakin was approached by ANHCA chief operating officer Cameron MacRae.

The association represents more than 1000 neighbourhood houses across the nation, including men’s and women’s sheds and community learning centres.

“Each of these community organisations rely on an income tax exemption to be financially viable and deliver their important work, and many are run by a team of volunteers with little to no legal or accounting experience,’ said Mr MacRae.

“It is critical that we can provide appropriate support to these groups as they grapple with the administrative reforms, because if we don’t, the potential losses are huge.”

“Almost all the documents we review do not meet the requirements set out under the new obligations, so it’s critical we act fast.”

ATO assistant commissioner Jennifer Moltisanti said the new reporting requirements have been introduced to enhance transparency and integrity in the tax, super and registry system by ensuring only eligible non-charitable NFPs access the income tax exemption.

She said the ATO is helping the more than 150,000 NFPs affected by the changes to get ready now before the new regulations come into effect.

“It’s important to us that affected not-for-profits understand the new reporting requirements and are prepared to lodge their first annual return come 1 July,” said Ms Moltisanti.

“Even though the due date is in October, there are things you should do now to make sure you are ready. We also recommend not waiting until the last moment to report. You can report from as early as 1 July.”

Non-charitable NFPs who have an active ABN can get ready now by:

Ms Moltisanti said that when it comes time to lodge, NFPs can use online services for business which lets organisations manage their reporting at a convenient time.

For NFPs that have engaged a registered tax agent, their agent can lodge on their behalf through online services for agents.

Ms Moltisanti said as an interim arrangement for the 2023–24 transitional year, eligible NFPs unable to lodge online will be able to submit their NFP self-review return using an interactive voice response phone service

“This new reporting requirement will help drive a level-playing field, giving confidence to not-for-profits that only organisations who are entitled to concessions can access those concessions.”

The ATO said the reforms, which were first announced in the 2021 federal budget, are designed to enhance trust and confidence in the sector by ensuring that only eligible NFPs access income tax exemptions, and that NFPs operate on a level playing field.

Under the new regime, NFPs must ensure that their constitutions up to date, their statement of purpose is compliant, and their policies fulfill relevant obligations.

Alternatively, some organisations may decide that registering as a charity is a better way to ensure they don’t lose their tax concessions – a process Mr MacRae said has its own set of criteria to be managed.

Mr MacRae – who is currently studying for a Juris Doctor at Deakin Law School – has been running weekly forums for Neighbourhood Houses to help guide them in managing the changes.

He approached Deakin for help after realising that the new regulations were a ticking time bomb for his member organisations, as well as other NFPs around Australia, if they didn’t have the skills or understanding to address them properly.

“Most of our members have written up their founding documents decades ago and haven’t revisited them since,” said Mr MacRae.

“Almost all the documents we review do not meet the requirements set out under the new obligations, so it’s critical we act fast.”

Mr MacRae hopes the online tool developed by Deakin will drive greater engagement from a wider group of organisations, and that leaders will be able to use it to gain a better insight into their organisation’s individual requirements.

Professor Lightowlers said the project was an example of Deakin’s commitment to working with the community to solve real world problems.

“We’re always asking how we can make a difference, how we can use our expertise to make a meaningful change in the world,” she said.

“So, when Cameron approached us with this problem, it offered the perfect opportunity to put our values into practice.”

The online tool has been rolled out to more than 1000 community groups associated with neighbourhood houses in Australia, and Deakin is in talks with local councils and industry associations to adapt the system to suit the needs of other NFPs.

More information

Posted on 18 Feb 2026

Around 50 per cent of all funding for charities in Australia comes from government. The nature of…

Posted on 18 Feb 2026

You wouldn’t try to fix a complex system with one tool. You’d widen the toolkit, improve the…

Posted on 18 Feb 2026

Australia’s champion laundry van charity, Orange Sky, has announced it is ready to expand into…

Posted on 18 Feb 2026

To have any hope of hitting the grand plan of doubling philanthropy by 2030, Australia needs one…

Posted on 18 Feb 2026

When Nyiyaparli woman Jahna Cedar travels to New York next month as part of the Australian…

Posted on 17 Feb 2026

This is the full academic version of Dr Oksana King's thoughts on the need to better compensate and…

Posted on 12 Feb 2026

Our special NFP trends report distils the views of more than two dozen experts.

Posted on 11 Feb 2026

The ballooning cost-of-living crisis is affecting Australian families to the extent that many…

Posted on 11 Feb 2026

Rev. Salesi Faupula is the Uniting Church’s moderator for the synod of Victoria and Tasmania. Born…

Posted on 11 Feb 2026

Service providers have expressed cautious support for the federal government’s Thriving Kids…

Posted on 11 Feb 2026

Australia’s not-for-profits need strategic investment by the federal government to support the…

Posted on 11 Feb 2026

For the first time, charities commissioner Sue Woodward has confirmed the Australian Charities and…