Why women’s collective giving is a great growth opportunity in fundraising

Posted on 11 Mar 2026

Australia is entering the largest intergenerational wealth transfer in its history. Over the next…

Posted on 08 Jul 2025

By Greg Thom, journalist, Institute of Community Directors Australia

Not-for-profits yet to lodge their overdue self-review return will have to prove they have taken steps to do so, or face being probed by the Australian Taxation Office (ATO).

Penalties for failing to meet legally mandated deadlines for submitting the required information start at $330 for each month beyond the missed due date for small entities (capped at $1,650).

The penalty rate is double that for medium sized organisations with turnover of between $1 million and $20 million, and it increases fivefold for large entities with assessable income of more than $20 million.

The ATO has confirmed it will waive penalties for late lodgment of the inaugural 2023–24 self-review return by NFPs it believes have genuinely tried to do the right thing in the transition to the new system, introduced on July 1 last year.

However, the ATO said it would take a dim view of organisations seen to be deliberately dragging the chain on meeting their legal requirements to lodge the self-review return.

Under the new system, non-charities with an Australian Business Number (ABN) must lodge the annual return or face losing their tax-exempt status.

The ATO said just 29,500 out of more than 100,000 eligible NFPs had submitted a self-review return by June 30. The latest figures represent an increase of just 500 since May 30.

“It's important NFPs demonstrate they have taken steps to meet their lodgement obligation.”

In response to questions from the Community Advocate, an ATO spokesperson said the penalty waiver was intended to help NFPs who were trying to do the right thing but who had missed the lodgement deadline - which has been repeatedly extended.

“With the start of a new financial year, it is important all NFPs are aware of their obligations and don’t delay lodging their first return,” the ATO spokesperson said.

“The ATO will support NFPs genuinely trying to do the right thing and have suspended penalty application for late lodgement of the 2023–24 NFP self-review return as part of the transitional support arrangements for the sector.”

However, the tax office took a more ominous tone with NFPs it believed may be deliberately avoiding their responsibilities to file a return.

“From July 2025, the ATO will start to review NFPs that intentionally ignore their obligations.

“NFPs that haven’t lodged their first return are required to lodge their 2023–24 return as soon as possible to avoid a review.

“It's important NFPs demonstrate they have taken steps to meet their lodgement obligation.”

The ATO can penalise taxpayers who fail to meet their obligations to lodge or report by a given due date.

The penalty amount is determined by the size if the entity concerned and the length of time that has elapsed since the ATO lodgement deadline.

According to the ATO website, if the infringement occurred after November 7, 2024, a “penalty unit” of $330 applies.

The number of penalty units issued for Failure To Lodge (FTL) increases depending on the size of the organisation being fined.

Calculated at the rate of one penalty unit for each period of 28 days (or part thereof) that the return or statement is overdue, up to a maximum of five penalty units.

The fine for organisations with assessable income or turnover of more than $1 million and less than $20 million is double that of small entities.

Large entities with assessable income of more than $20 million are subject to being fined in penalty units five times the basic rate.

Source: ATO

The ATO said about 97 per cent of NFPs who have so far lodged a self-review return have confirmed their eligibility for an income tax exemption.

The ATO said NFPs that have already lodged their 2023-24 return will have their 2024-25 and future year returns pre-populated in the tax office's online system, making the process easier in the future.

“If NFPs haven’t yet lodged their NFP self-review return, when they log into online services for business this tax time, they will have two returns due,” said the ATO spokesperson.

“NFPs need to lodge their 2023–24 return first, as returns need to be lodged sequentially.”

The self-review return is due between July 1 and October 31 each year.

The ATO has repeatedly defended the self-review changes, which it has said will lead to greater transparency, and. It claims it has consulted the sector extensively, and it says the changes are easy to navigate.

However, the rollout has been criticised by sector advocates and former shadow charities minister Senator Dean Smith, who instigated a Senate inquiry into the process.

That inquiry heard complaints about poor communication, a complex process, unnecessary red tape and higher costs for organisations seeking accounting and legal advice.

Self-review tax return changing NFP landscape: ATO

Posted on 11 Mar 2026

Australia is entering the largest intergenerational wealth transfer in its history. Over the next…

Posted on 11 Mar 2026

The founder and driving force behind the women’s philanthropic project She Gives, Melissa Smith,…

Posted on 11 Mar 2026

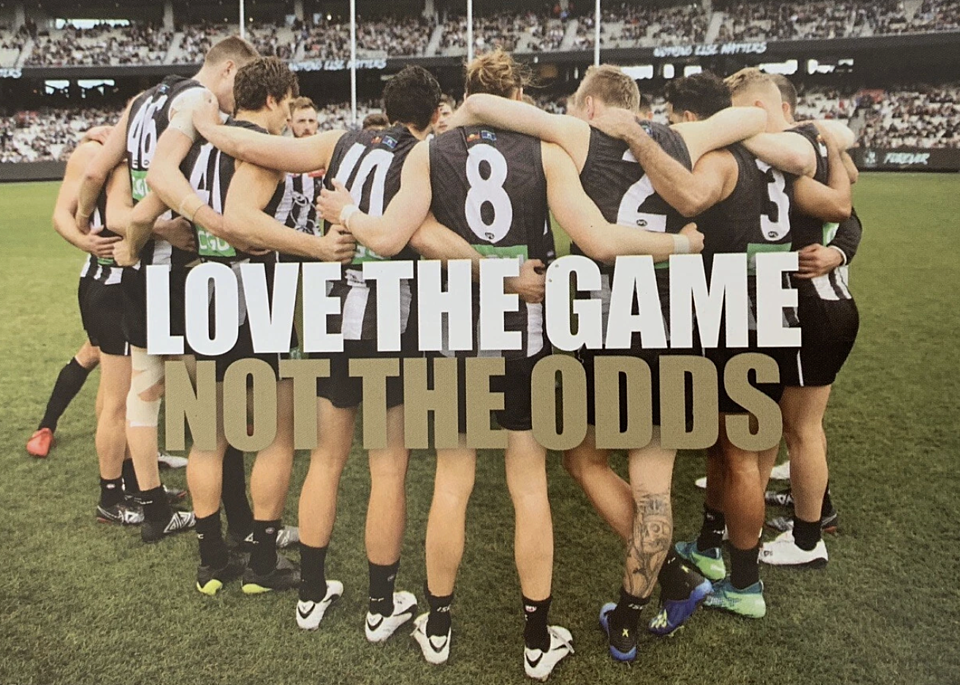

Footy is back, from rugby league in Las Vegas to Aussie Rules at the MCG, and you know what that…

Posted on 11 Mar 2026

Australia has offered asylum to members of the Iranian football team. That’s fine, but it does draw…

Posted on 11 Mar 2026

Applications are now open for the 2026 Joan Kirner Emerging Leaders Program, a fully funded…

Posted on 10 Mar 2026

Despite having a high-powered day job as a partner with Gilbert + Tobin, lawyer Catherine Kelso…

Posted on 10 Mar 2026

Australia’s future is being shaped right now in our migration and settlement systems. But too…

Posted on 04 Mar 2026

The federal government has announced its decision on the percentage of assets that giving funds…

Posted on 04 Mar 2026

Australia’s for-purpose enterprise supporting Indigenous-owned businesses announced a record $5.83…

Posted on 04 Mar 2026

Hannah Nichols is the environmental, social and governance (ESG) lead at Australian Red Cross and a…

Posted on 04 Mar 2026

Major workflow software company Atlassian has announced it is offering its Teamwork Collection of…

Posted on 04 Mar 2026

In all charities and NFPs – big and small – annual budgeting brings with it a degree of…