Women already drive philanthropy in Australia – now She Gives wants them recognised

Posted on 11 Mar 2026

The founder and driving force behind the women’s philanthropic project She Gives, Melissa Smith,…

Posted on 14 Oct 2024

By Greg Thom, journalist, Institute of Community Directors Australia

The Australian Tax Office has acknowledged resistance to controversial changes to self-reporting rules for non-charitable not-for-profits, but insists the changes are needed.

The new rules introduced in July, require NFPs with an Australian Business Number (ABN) to lodge an annual “self-review” tax return or risk losing their income tax exemption, unless they register as a charity.

However, Moltisanti rejected suggestions the new rules, which sparked widespread anxiety throughout the sector and are now the subject of a Senate inquiry, are not worthwhile.

“I’ve also read some media articles that suggest ‘this measure is creating a lot of extra work and raising concerns for many while providing very limited if any tangible benefit.’

“This is simply untrue, as the return is only asking NFPs to notify us of their eligibility to self-assess as income tax exempt,” said Moltisanti.

“NFPs have always had to undertake this review, however, this year marks the first year of an annual reporting cycle.”

Moltisanti’s comments fly in the face of submissions to the Senate inquiry into the tax changes which express deep reservations about the new rules impact.

The Charities and Not-for-profits Committee of the Law Council of Australia in its submission, said it was “very concerned” about the implementation of the changes.

The Charities and Not-for-profits Committee of the Law Council of Australia’s Legal Practice Section cited multiple concerns over the ATO tax changes affecting NFPs, including:

The submission dismissed suggestions by the ATO that the requirement to lodge a self-review return was not onerous, because NFPs should already have been conducting an annual self-review of their tax status.

“However, consultation may have shown this was not the case, as many NFPs have been alarmed and confused by receiving the communications from the ATO in relation to lodging a return.”

The Law Council submission also disputed claims by the ATO that the process for lodging a self-review return was simple.

“The Committee is aware of many confused and concerned NFPs that don’t know where to turn for assistance, which is why we welcome this review by the Senate Economics References Committee.”

The Community Council for Australia (CCA) in its submission also criticised the ATO’s policy, which it said “makes no policy or practical sense.”

CCA said most of the work involved in delivering the ATO changes will have to be provided by small volunteer organisations that have limited capacity to complete the task.

“If this measure is about the core role of the ATO, collecting taxation revenue, it should target organisations that may have significant unfulfilled tax obligations.

“In practice, this measure mostly targets micro volunteer run organisations by imposing significant new obligations that are likely to produce no significant benefit to anyone.”

Key concerns with the ATO NFP tax changes cited by CCA include:

CCA said the ATO changes impose a new risk on every small NFP in Australia.

“If self-assessed income tax exempt organisations get their self-assessment wrong, they could find their organisation facing a retrospective debt going back years.

“This risk, however remote, can and does create a chill factor for many NFPs.”

“The new NFP self-review return has been implemented to obtain appropriate sector transparency and integrity.”

Contrary to reports of widespread sector frustration and uncertainty, Moltisanti maintained that many organisations have embraced the new reporting requirements.

She also doubled down on the reasons why the changes were introduced.

“The new NFP self-review return has been implemented to obtain appropriate sector transparency and integrity,” elements Moltisanti said were essential in a democratic society.

“As the key revenue agency for Australia, it’s imperative we the [ATO] can confidently assure the government and the Australian community that the NFP sector are meeting all their tax and super obligations.

“This should be no surprise and I’ve consistently shared our role with the sector.”

Moltisanti said that the ATO would not hesitate to revoke an NFP’s entitlement to tax concessions, such as deductible gift recipient (DGR) status or income tax exemptions if an organisation was found ineligible.

She highlighted several benefits of the changes, including:

“I’ve regularly reminded the sector that the NFP self-review return should be seen as an opportunity to review and reset.

“Many NFPs agree, and I know many more are engaging," Moltisanti said.

The ATO said more than 10,000 self-review returns have been lodged so far, with that number continuing to climb.

Moltisanti said hundreds more NFPs had clarified whether they were charitable or taxable organisations.

Many NFPs rushed to seek charity status to avoid the new forms, sparking a three-month backlog with the Australian Charities and Not-for-profits Commission (ACNC) earlier this year.

It is a situation the ATO says it is working with the ACNC to address.

Despite the angst about the changes, particularly among smaller organisations, the ATO said it had no plans to simplify the changes, which will affect more than 155,000 NFPs.

The implementation of the new rules is the subject of a public inquiry instigated by shadow charities minister Senator Dean Smith, who said he was responding to reports by sector organisations of a chaotic rollout process, characterised by vagueness and poor communication.

“This motion is the result of growing concerns raised with me by anxious, sometimes angry, not-for-profits across Australia,” said Senator Smith said.

The inquiry by the Senate Economics References Committee is due to report on its findings by October 31.

Posted on 11 Mar 2026

The founder and driving force behind the women’s philanthropic project She Gives, Melissa Smith,…

Posted on 11 Mar 2026

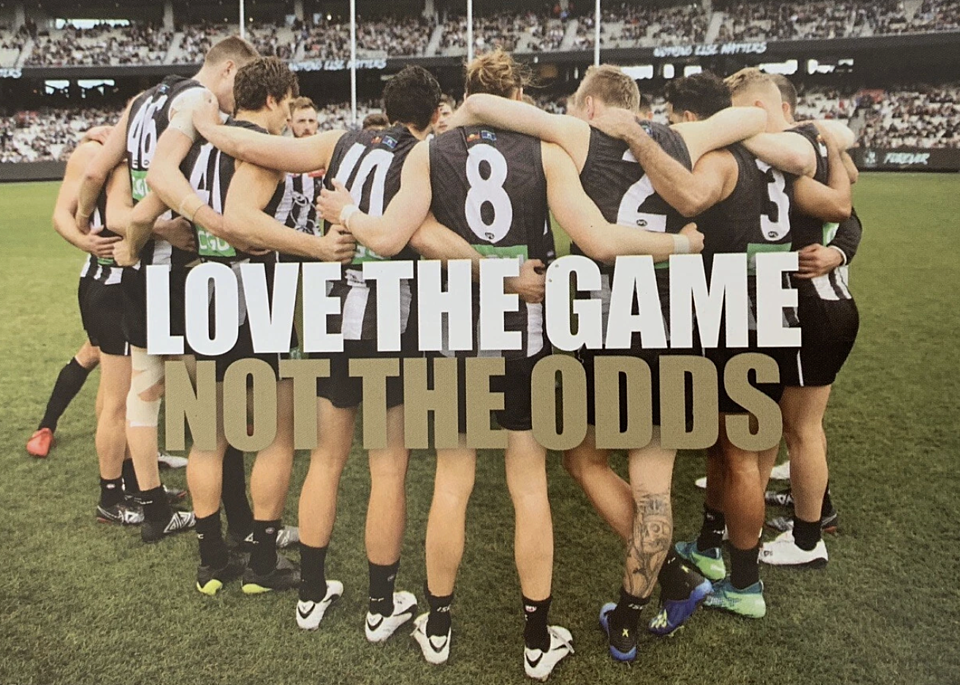

Footy is back, from rugby league in Las Vegas to Aussie Rules at the MCG, and you know what that…

Posted on 11 Mar 2026

Australia has offered asylum to members of the Iranian football team. That’s fine, but it does draw…

Posted on 11 Mar 2026

Applications are now open for the 2026 Joan Kirner Emerging Leaders Program, a fully funded…

Posted on 10 Mar 2026

Despite having a high-powered day job as a partner with Gilbert + Tobin, lawyer Catherine Kelso…

Posted on 10 Mar 2026

Australia’s future is being shaped right now in our migration and settlement systems. But too…

Posted on 04 Mar 2026

The federal government has announced its decision on the percentage of assets that giving funds…

Posted on 04 Mar 2026

Australia’s for-purpose enterprise supporting Indigenous-owned businesses announced a record $5.83…

Posted on 04 Mar 2026

Hannah Nichols is the environmental, social and governance (ESG) lead at Australian Red Cross and a…

Posted on 04 Mar 2026

Major workflow software company Atlassian has announced it is offering its Teamwork Collection of…

Posted on 04 Mar 2026

In all charities and NFPs – big and small – annual budgeting brings with it a degree of…

Posted on 04 Mar 2026

New research from Diversity Council Australia (DCA) has found that even as one in four workers…